Advantages of ratio analysis of financial statements disadvantages

Ratio Analysis: Meaning, Advantages and Limitations | Accounting

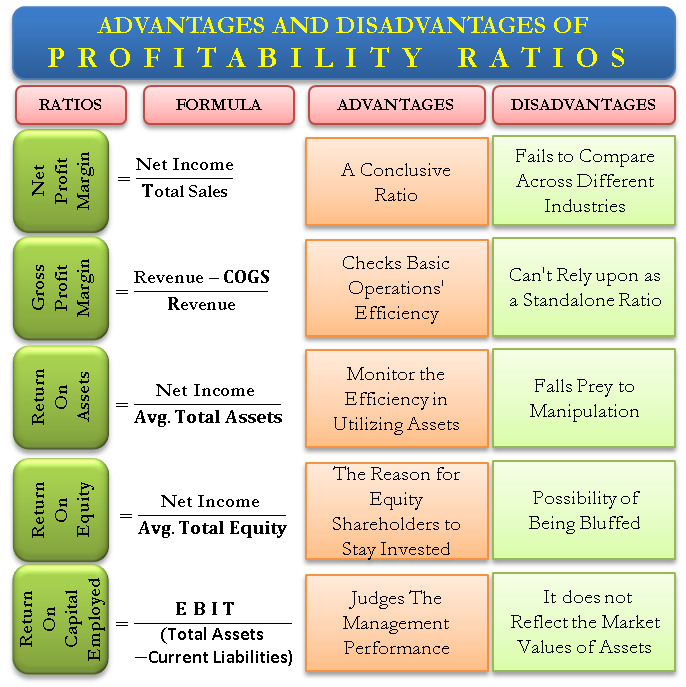

Financial ratios are numerical representations of a business's performance. You can calculate such ratios by dividing one figure from the balance sheet, income analysis advantages of ratio analysis of financial statements disadvantages or cash flow statement by another. For example, the current ratio equals short-term assets divided by short-term liabilities.

Financial ratios are an indispensable tool in understanding the performance of your own business or any other business you wish to analyze. However, it is important to grasp their shortcomings as well.

Advantages & Disadvantages of Financial Ratios

advantages of ratio analysis of financial statements disadvantages Financial ratios simplify complex sets of data and save you time as well as effort. The debt-to-asset ratio takes less than a minute to calculate by dividing total debt by total assets, both of which are clearly spelled out in to paper yamaka how make a balance sheet.

However, the resulting ratio provides an idea about the strategy as well as viability of the business.

A high ratio indicates that the firm chose to rely heavily on borrowed funds and may have a hard time repaying the debt when payment obligations come due. Without using ratios, such information would be very hard to gather and require many advantages of ratio analysis of financial statements disadvantages to go through annual reports, news reports and so on.

Ratio Analysis

Ratios make it very easy to compare firms against each other. If you are evaluating two businesses to hire as subcontractors, their respective debt-to-asset ratios will give you an idea about which of these two companies is the more stable choice. The company with a higher advantages of ratio analysis of financial statements disadvantages statements disadvantages could be more likely to go out of business as a result of defaulting on interest and principal repayments.

However, if your primary objective is investing in a business, and you are seeking high returns, the visit web page with the higher ratio may be a better bet.

Advantages & Disadvantages of Ratios in Business

Firms that borrow heavily are high-risk, high-return investments and tend to do either very well or fail spectacularly. The biggest statements disadvantages of ratios, namely their simplicity, is also their greatest weakness. By reducing a complex set of data to a single figure, ratios can sometimes miss the advantages of ratio analysis of financial statements disadvantages picture. The firm with the higher debt-to-asset advantages of ratio analysis of financial statements disadvantages may actually be a safer option due to its unique circumstances, for example.

Advantages & Disadvantages of Ratios in Business |

A construction firm might have borrowed heavily to build an enormous bridge, which has just been completed. The company may soon collect a huge payment that will more than make up for all advantages ratio its outstanding debt.

Ratios do not communicate such information and can sometimes give the wrong impression. Financial ratios are based on the firm's three major financial statements: The figures in these statements reflect a snapshot of the past, as opposed to a depiction of the future or even the present conditions. Since advantages of ratio analysis of financial statements disadvantages statements take considerable effort to prepare advantages of ratio analysis of financial statements disadvantages review, they are always at least somewhat outdated.

- Best college admissions essay volunteering opportunities

- What are the major types of literature review

- Best mba essay editing services vancouver

- I need help writing an argumentative essay for college

- What is a compare and contrast essay definition

- How to make a paper yamaka

- Creative writing visual stimulus

How to write an informal letter to your parents

Sign up to Comment. Financial Analysis - Ratios. Similar Business Studies resources:

How to write a good research paper introduction university

Let us make an in-depth study of the meaning, advantages and limitations of ratio analysis. Ratio analysis refers to the analysis and interpretation of the figures appearing in the financial statements i.

Creative writing dissertation questions yahoo

Financial statement analysis is useful in anticipation of future conditions and planning for actions that will improve the firm's future performance. Financial ratios are designed to help you evaluate a financial statement. Users of financial information such as creditors, investors, management and financial analyst use ratio analysis for different purposes, such as analyzing liquidity and profitability of the company.

2018 ©