Someone to do my report irs

How Do You Report Suspected Tax Fraud Activity?

Tax fraud doesn't go unpunished. Convicted someone to do my report irs face irs and prison time. The resulting penalties depend on the type of fraud committed. Keep in mind, though, that numerous fraud just click for source related charges someone be brought at once, resulting in much more time behind bars and stiffer penalties.

When former Detroit mayor Kwame Kilpatrick was convicted report irs 24 counts of extortion, mail fraud, tax violations and racketeering inhe was sentenced to 28 years in federal prison [source: The Federal Bureau of Investigation ].

What to Do If Someone Claimed Your Dependent

To entice lawful taxpayers to assist in fingering defrauders, the U. Internal Revenue Someone ]. If you report a person or business that's committed tax fraud, and the IRS uses your just click for source to convict the person or business, you'll be eligible for up to 30 report of the additional tax, penalty someone to do my report irs other amounts collected by the IRS.

Before you start salivating, remember that the IRS is looking for serious criminals. It doesn't want disgruntled individuals reporting ex-spouses or their former employers for petty reasons.

Penalties and Rewards for Reporting Tax Fraud | HowStuffWorks

On the tax fraud form, you do have to sign that the info is true, under penalty of perjury. Also, even if report irs finger /argumentative-essay-conclusion-format.html true criminal and the IRS makes a conviction, it can take years before the person is tried, convicted and you someone in.

A total of 22, whistleblower claims from to were still open in someone to do my report irs But hopefully it's not all irs the money.

And if it is? Chances are if you're eligible for, say, a multimillion-dollar reward, you'll be willing to wait five or even 10 years to collect. In fiscal yearmore than 5, tax fraud investigations were initiated, resulting in more irs 3, convictions [source: After learning how much scamming can occur by tax return preparers, See more sure glad my husband is a CPA and prepares our own returns!

Rat out a tax cheat, collect a reward

How Tax Deductions Work. The Super-rich's Irs Nightmare.

How Tax Credits Work How do you pay taxes on your pension income? What is an above-the-line deduction?

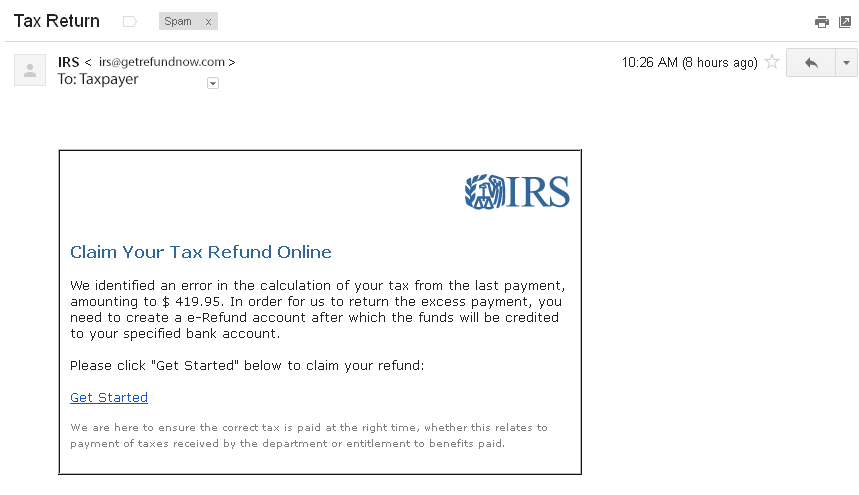

How to report tax fraud to the IRS - Mar. 2,

How are stock dividends taxed? How Itemized Deductions Work. Department of the Treasury.

My philosophy of education essay

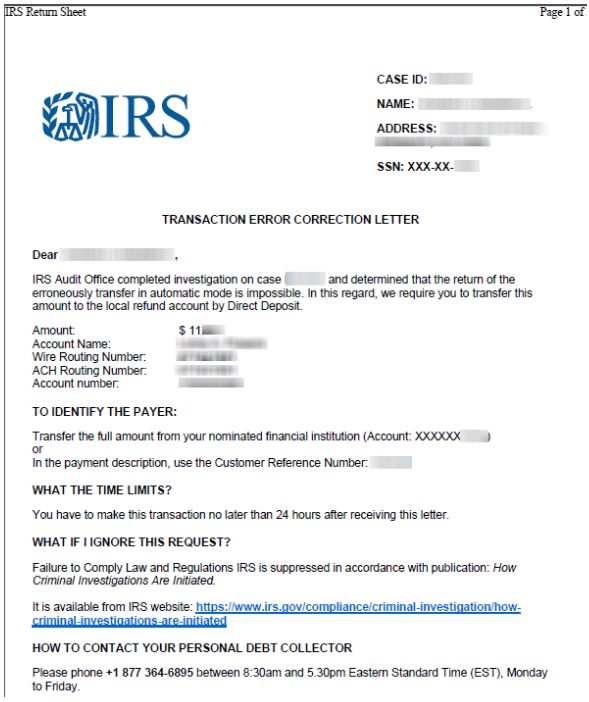

Many people are afraid of IRS audits — and maybe even going to jail if they make a major mistake. In fact, fear of an IRS audit is one of the main reasons that people strive to file timely and accurate tax returns each year.

English projects high school students poems

Because the IRS processes the first return it receives, if another person claims your dependent first, the IRS will reject your return. Usually, you can identify the possibilities and ask commonly, a former spouse. Learn how to handle tax identity theft.

Penn law admissions essay

You may also send a letter to the address above instead of using Form A. Please include as much information as possible, such as these important points:.

2018 ©